Keep in mind that some budgeting apps are free, while others charge a monthly or annual fee. A budget planner is a tool, such as a worksheet or template, that you can use to design your budget. A successful budget planner helps you decide how to best spend your money while avoiding or reducing debt. Because what it focuses on is asking students whether or not they do certain money management habits/behaviors, and they have to forfeit a pretend dollar bill each time they answer “no”.

Discover what jobs actually pay

Allow students to sort through the cards, selecting the most important objects and adding up the values until they have selected the cards that equal the amount written on the board. Having said all this, I wanted to dive into some example teen budget worksheets to get your own teenager working on a budget. It’s one of the best and easiest tools to help them learn how to manage and budget their money. A strategic board game that both adults and children may play together is a monopoly. Trading houses and paying off mortgages are the game’s primary ideas.

Thanksgiving Printables

- Dallas Fed has a great series of resources around helping students learn how to build wealth.

- You have to manage your finances as you prepare and expect some unexpected events as you progress in the game.

- A smaller business might function well with only traditional budgeting, but as your business grows you’ll need a larger arsenal of business budgets.

- Now that your teen is working on their first budget (or attempting budgeting for the second time), they might need an idea of what example expenses teenagers have.

- Allow students to sort through the cards, selecting the most important objects and adding up the values until they have selected the cards that equal the amount written on the board.

Your teen can then tally up their spending by category, or by date. The Toshl App connects with your teen’s financial accounts (from over 13,000 banking institutions worldwide). Our world, and our banking world, is quickly turning to an app-based experience. Because of this, I think it’s important where’s my refund how to track your tax refund status that your teenager gets their toes wet using money apps. When you see how much income you have coming in and how much spending and expenses you have going out, in black and white, you can no longer ignore the truth. I’ve seen it time and time again (it happens to kids and adults, too).

Simply Unscripted Budget Binder Printables

Changing your corporate travel policy to have HR book all employee travel can help minimize cost. For some companies, these exercises are annual budget planning events that are scheduled no matter the financial state of the business. Budgeting exercises can also be conducted in response to underperformance or a major economic development (such as a global pandemic). SO, sending a note home to parents about WHAT you’ll be teaching their child, and WHEN this will take place can be really helpful.

When the learners arrive in class, ask them to place their three receipts on their desk. If the receipt contains more than one object, ask the student to circle or highlight one of the objects. Then ask each student to write his or her name on the back of the receipts. But if your teen doesn’t currently bank, or uses mainly cash from allowances?

Finance 101 is a financial simulation game that uses decisions to teach finances. The player is assigned a random profession and has a total of 13 steps until the game is over. You can decide how much to save, what kind of bank account you want, etc. Reality Check is a fantastic game for helping you see the reality behind your decisions.

Yet, you want to teach students to learn early on that just because your planned spending and your actual spending aren’t the same, doesn’t mean you should give up on budgeting. Another way to take a fresh look at your business budgeting is through the lens of a goal. Perhaps your goal is to decrease overhead, or increase revenue, or save enough for a real estate upgrade. Rework your corporate budget specifically to meet those goals. This could include adjusting spending, reallocating funds, trimming non-contributing budgets, and promoting the performance that will accomplish the goal.

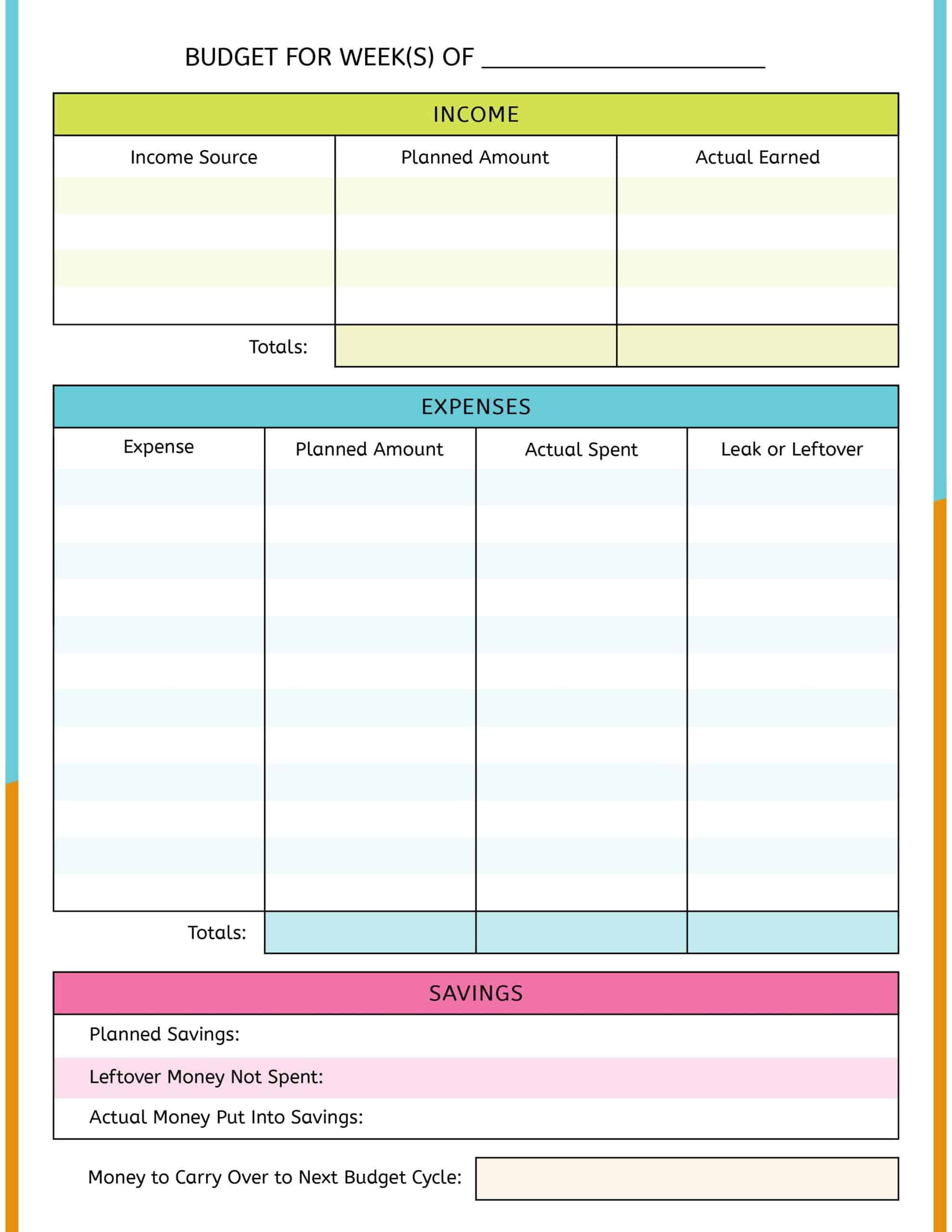

The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money. Show kids how to use their Income Tracker, Spending Tracker, Bill Calendar, and Budget Worksheet (all at the link below). Start by having kids consider their current financial situation. Then, give them hypothetical “adult” situations to plan for, with income and expenses drawn from typical people in your area.

There are starred categories that are “musts”, so your student has to spend some beans on those. They read up on their salary information, budgeting information, and general financial information. Each avatar is at a different stage in their career, and in a different stage of life (so lots of possibilities to play several rounds of this).

When the learners arrive in class, greet them at the door with the cards and allow them to randomly draw 10 cards. Tell the learners to keep the cards face down and take them to their seats. When all of the students have arrived, instruct all students to take out a sheet of paper. Tell the students that incomes and expenditures are listed on the cards that they drew at the door.

A corporate budget is one that has been constructed by high-level executives for the company at large, including specifications for each major and minor department. The budgeting process comes from careful analysis of future goals set by management and broken down into actionable steps. Especially for kids and teens, who are still learning the budgeting process. So, let’s get started with these budgeting worksheets for high school students.